As financial institutions push forward with digital transformation, they face increasing demands to balance efficiency with stringent regulatory requirements and security challenges. In a world where threats are evolving as fast as technology, Identity and Access Management (IAM) is emerging as a cornerstone for building secure, compliant, and resilient financial services. This blog series explores IAM’s transformative role in finance, covering essential elements like role-based access control, access reviews, compliance reporting, approval workflows, and proactive fraud prevention.

Building the Foundation: Compliance, Security, and Efficiency with IAM

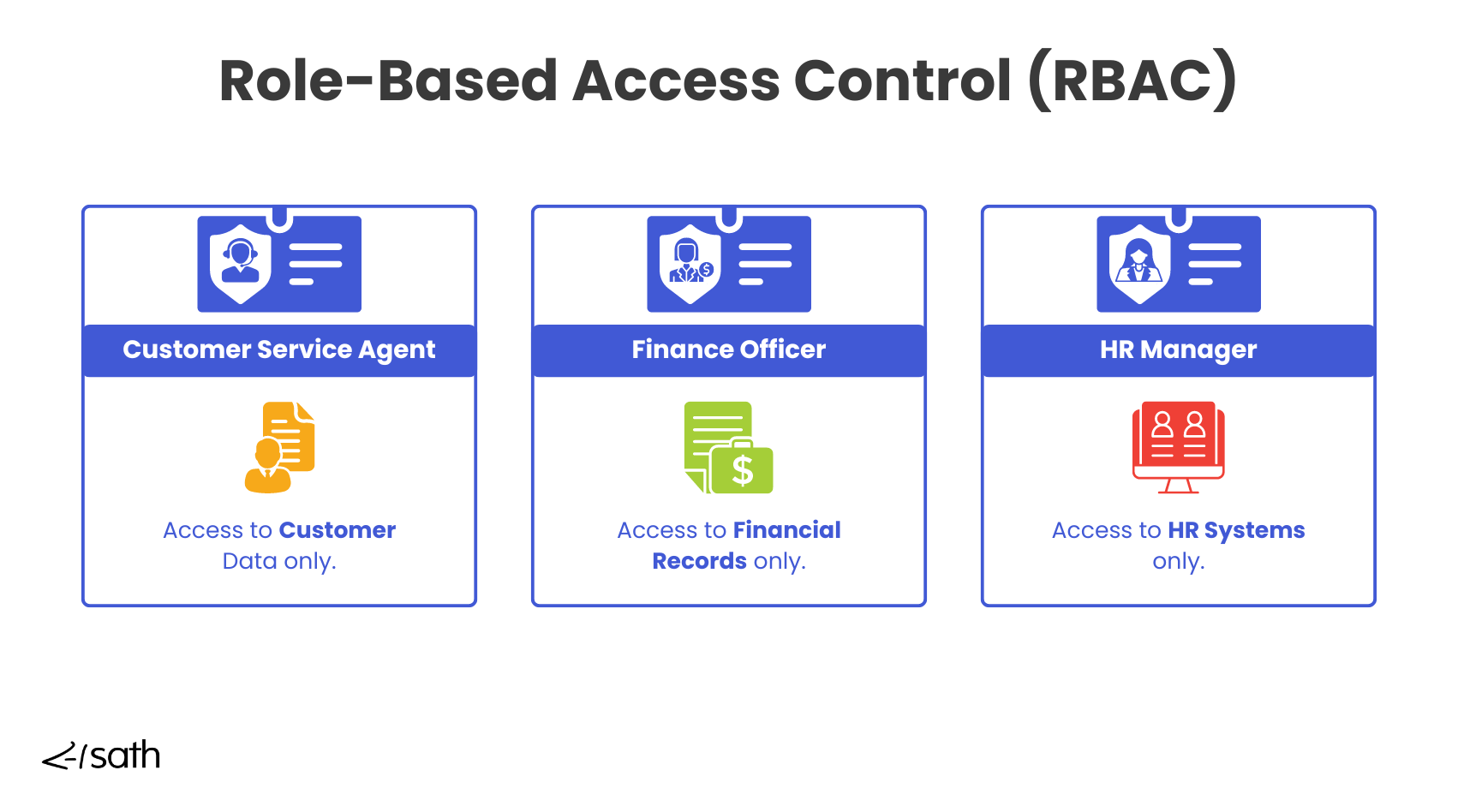

In finance, regulatory compliance isn’t just a box to check—it’s a foundation for trust and credibility. Part 1 of the series shows how IAM solutions empower financial institutions to meet strict standards like GDPR, SOX, and PCI-DSS while streamlining security and operational efficiency. IAM’s role-based access control is at the heart of these solutions, allowing institutions to assign and monitor access based on specific job functions and needs, preventing unnecessary exposure to sensitive data.

For example, IAM automates onboarding and offboarding, ensuring that employees have immediate access to necessary applications when they join and lose access promptly when they leave. This level of precision in managing the user lifecycle not only protects sensitive data but also simplifies workflows for IT teams, helping institutions operate efficiently while maintaining tight security standards.

Overcoming Unique IAM Challenges in Finance

The complex nature of financial organizations makes managing access far more challenging. Financial institutions deal with high turnover, multiple departments, and diverse roles—each with unique access needs. Part 2 discusses how IAM solutions address these specific challenges, offering flexibility and scalability to keep financial firms secure and agile.

IAM solutions address these complexities by enabling organizations to adapt access permissions to changing regulatory standards and business needs. Approval workflows help manage access requests, streamlining the process for granting permissions by ensuring that the right people are involved in review and authorization. IAM also allows organizations to easily add or remove third-party vendors, a critical component in an industry where outsourcing and partnerships are increasingly common. By simplifying these workflows and providing adaptable solutions, IAM enables institutions to maintain security without compromising on operational efficiency.

Streamlining Access Reviews and Compliance Reporting

For financial institutions, compliance audits are a critical part of operations, and IAM simplifies these processes with automated access reviews and compliance reporting. Part 3 dives into how IAM helps financial firms stay audit-ready and compliant by maintaining continuous visibility into access permissions. Regular access reviews ensure that permissions are accurate and up-to-date, limiting access to only the necessary resources and reducing risk.

IAM systems offer streamlined, automated reporting for compliance audits, tracking all access-related activities and generating audit trails that auditors can rely on. This not only boosts reporting accuracy but also saves time and resources, ensuring that financial institutions can meet regulatory requirements confidently. By automating access reviews, IAM removes the burden of manually managing permissions and enables teams to focus on higher-priority tasks. With an IAM system in place, financial institutions can ensure compliance reporting is accurate, streamlined, and always ready for audits.

Guarding Against Insider Threats with IAM

While external threats tend to dominate the news, insider threats are just as concerning, especially in finance, where employees often have privileged access to sensitive data. Part 4 of the series highlights IAM’s role in mitigating insider risks by enforcing strict access controls and continuously monitoring access behaviors.

Through role-based access control, IAM ensures that employees only have access to what they need based on their role, reducing the likelihood of accidental or malicious data exposure. Identity and Access Management (IAM) solutions can also flag unusual activity, such as repeated access attempts or abnormal data requests, allowing institutions to act before a potential breach occurs. For example, if an employee in a non-financial role attempts to access financial records, IAM can immediately restrict access and notify the appropriate parties. By monitoring and managing access behaviors, IAM gives financial organizations an extra layer of security against insider threats, enhancing visibility and control over sensitive data.

Leveraging IAM to Prevent Financial Fraud

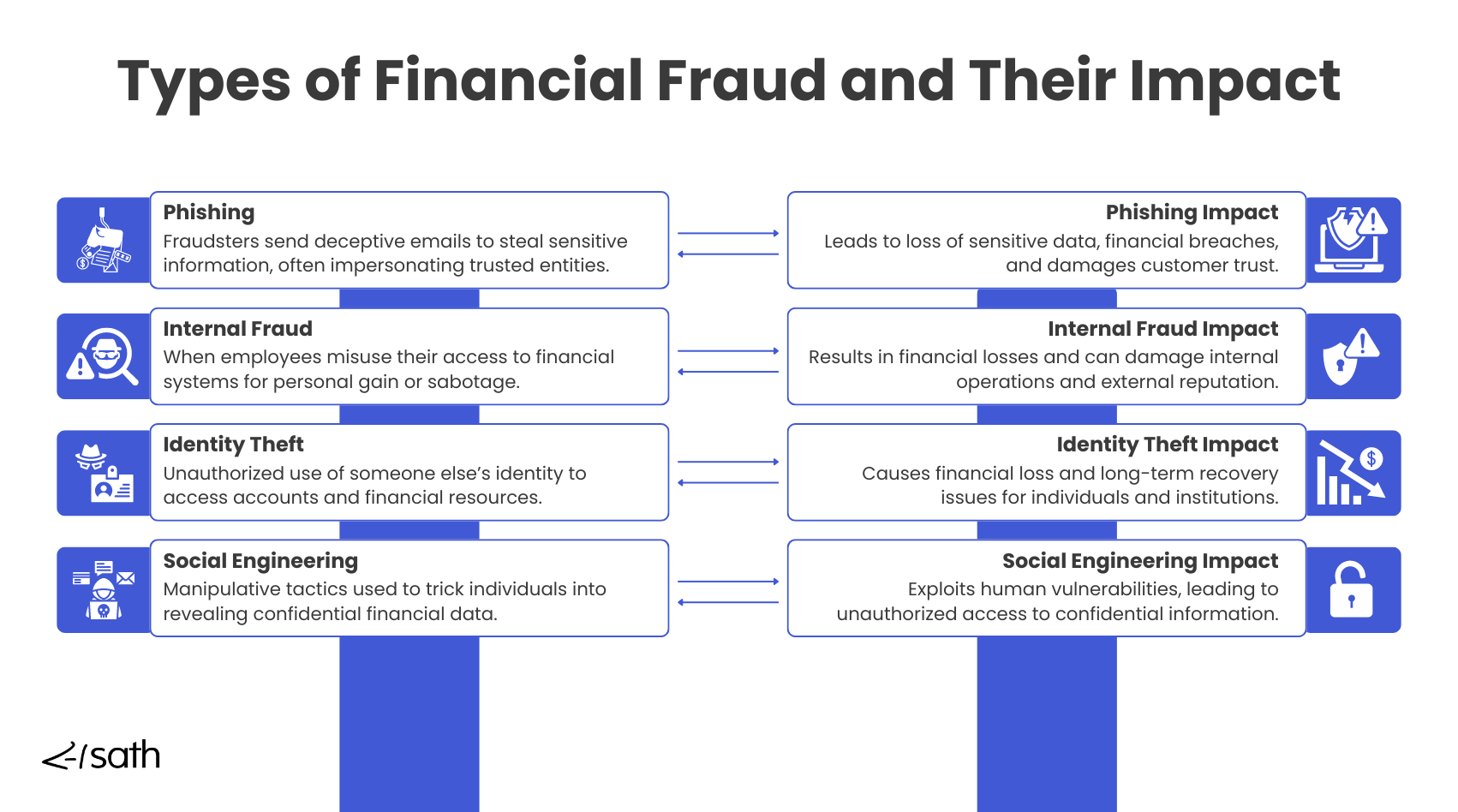

Financial fraud prevention is a top concern for financial institutions, and IAM’s ability to enforce role-based access and monitor user activity plays a key role in this area. In Part 5, IAM’s role in fraud prevention is examined, emphasizing how it enables financial organizations to restrict access based on necessity and monitor for suspicious activity in real time.

With IAM, financial institutions can track access requests and enforce granular permissions that reduce the chance of fraud. Role-based access control limits permissions strictly to what’s necessary, reducing opportunities for employees or third parties to misuse data. IAM systems also allow real-time monitoring of access behaviors, flagging unusual or unauthorized actions as they happen, which helps organizations detect potential fraud early. This proactive monitoring strengthens customer trust, as clients feel reassured knowing their sensitive information is well-guarded.

The Strategic Advantage of IAM in Finance

As financial institutions advance their digital strategies, IAM has become much more than a security tool—it’s a strategic advantage. By addressing compliance audits, simplifying workflows, and enhancing operational efficiency, IAM helps organizations meet the demands of modern finance while protecting their reputation and building customer trust.

Throughout this series, we see that IAM is more than access management; it’s a comprehensive solution for protecting sensitive data, maintaining regulatory compliance, and creating a secure environment for growth. By implementing robust IAM systems, financial institutions are better equipped to handle evolving challenges, from compliance to fraud prevention.

Key Takeaways from Securing the Future of Finance with IAM

This series illustrates that IAM is indispensable for financial institutions, addressing unique industry pain points and driving both security and efficiency. Here are some of the key takeaways:

- Meeting Regulatory Standards: IAM helps financial institutions meet stringent regulations, including GDPR, SOX, and PCI-DSS, through automated compliance reporting and audit trails, reducing the risk of non-compliance and the fines that can follow.

- Simplifying Workflows: Through automated onboarding, approval workflows, and access reviews, IAM streamlines complex processes, freeing up IT and security teams to focus on higher-value initiatives.

- Enhancing Access Control: Role-based access control ensures that users only have the permissions they need, reducing the risk of unauthorized access and simplifying access reviews.

- Proactively Detecting Insider Threats: IAM provides financial institutions with visibility into access behaviors, allowing them to detect and mitigate insider threats before they escalate.

- Preventing Financial Fraud: By enforcing granular permissions and real-time monitoring, IAM helps financial organizations prevent fraud and safeguard customer data.

Identity and Access Management (IAM) is leading the way to a secure, efficient, and compliant future. Financial institutions that invest in IAM are better prepared to protect their assets, meet evolving regulatory requirements, and build a foundation of trust with their customers. As the industry continues to change, IAM will remain a critical element in helping financial institutions navigate challenges, secure their operations, and foster a resilient foundation for growth.